The University did not fully prepare students for the effects of new rules governing student organization’s finances, said Aaron Turczynski, president of Student Accounting Society.

Under Student Organizations policy STU-01, which the Bloomington campus began implementing last fall, Student Organization Accounts will no longer handle student organizations’ finances.

“It’s part of the learning experience that students run the organization,” chief policy officer for the University, Jennifer Kincaid, said.

Some organizations will now have to establish a bank account and file taxes in order to collect money, but the University has not yet determined which organizations must do this.

The multi-year process of establishing the policy was inspired by similar rules at other Big Ten universities. Kincaid said the goal was to distinguish activities run by the university from those run by student organizations.

“The initial year transition is probably going to be very complicated, but once it gets going, I think, in the end, it will be easier,” Hubbard said.

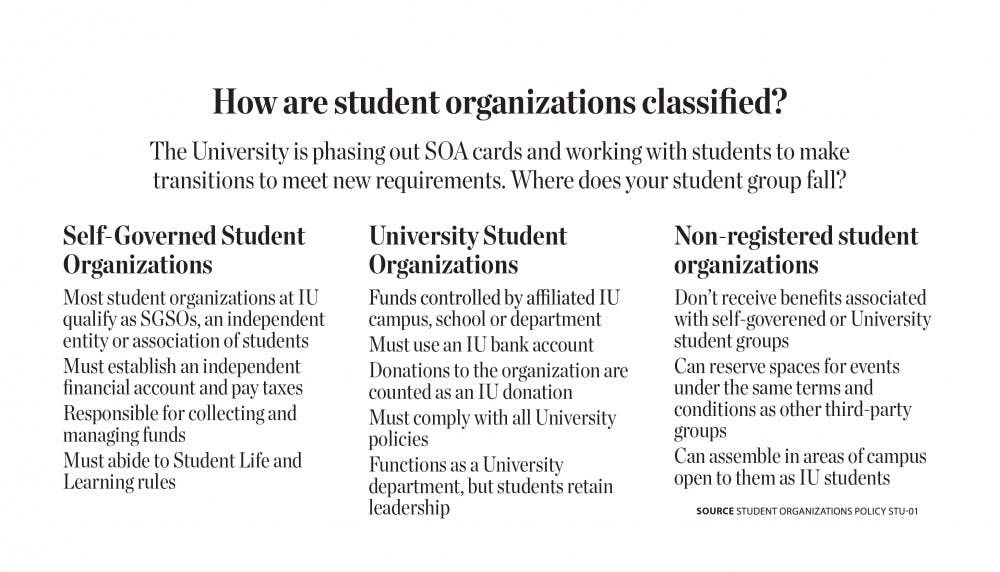

The policy creates three categories of student organizations: Self-Governed Student Organizations, University Student Organizations and non-registered student organizations.

University Student Organizations will function similarly to how student organizations have been set up in the past. They will be treated as operating units of IU, and a school or department will control their funds.

These are organizations the university believes are important, even if no students want to be in them, said Brittany Hubbard, University Bursar.

Most student organizations will be classified as Self-Governed Student Organizations, according to the policy. These organizations are independent of IU and are responsible for managing their finances.

Students must create bank accounts to collect funds for Self-Governed Student Organizations. To maintain the account as different students take leadership, it needs to be a business account. Business accounts are not associated with an individual, so no single student have financial ties to the account after they graduate.

Once an organization has a registered business account, it must pay corporate taxes.

“Most students don’t know how to do their personal taxes, nonetheless how to do corporation taxes,” Turczynski said.

If students want to avoid paying the corporate tax rate, they can file for nonprofit status. This involves a lengthy application process with the Internal Revenue Service, the national tax collection agency.

"You can't reasonably expect students to put this on themselves while going through their normal academic lives," Turczynski said.

Hubbard said the new system will benefit students by freeing them from SOA’s restrictions on purchases and vendors.

“I think my words would be, ‘Don’t panic,’” Hubbard said.

Student Accounting Society and several other student organizations first ran into problems in the fall when they tried using SOA’s online payment system, which is similar to PayPal.

Turczynski said the online service made collecting member dues easier and safer for his club of about 200 members.

When he realized SOA had taken the system away, Turczynski said he was unsure of what would come next.

Turczynski began speaking with SOA about the changes at the beginning of the academic year. SAS has since served as a test-runner for the transition to financial independence.

Hubbard said policies and procedures associated with the changes are still in the development phase.

“Our goal is to find a solution that works,” Hubbard said. “Not to just stop anything. We’re just implementing the policy.”

SOA is planning workshops and information sessions for the end of the spring semester and beginning of the fall semester. They will also create a website with resources to help students determine how to manage their money.

Several aspects of the transition were not considered until Turcyznski began the transition process himself, such as using Student Legal Services to ensure he filed for nonprofit status correctly.

"It's impossible to think about all these things unless you are a part of these things," Turcyznski said.

Turcyznski, a senior, has set up weekly SAS meetings from now until the end of the semester to pass financial information to next year’s board members.

He has created several documents summarizing his actions for other student organizations to reference.

Although SAS is now completely independent from SOA, Turcyznski said he will continue to work with representatives from SOA, Student Life and Learning and Student Legal Services to make sure the University understands the students' experiences.

“What does the school want to do at the end of all this? What are they comfortable with doing with all of this?” Turcyznski asked. “That's still yet to be determined.”