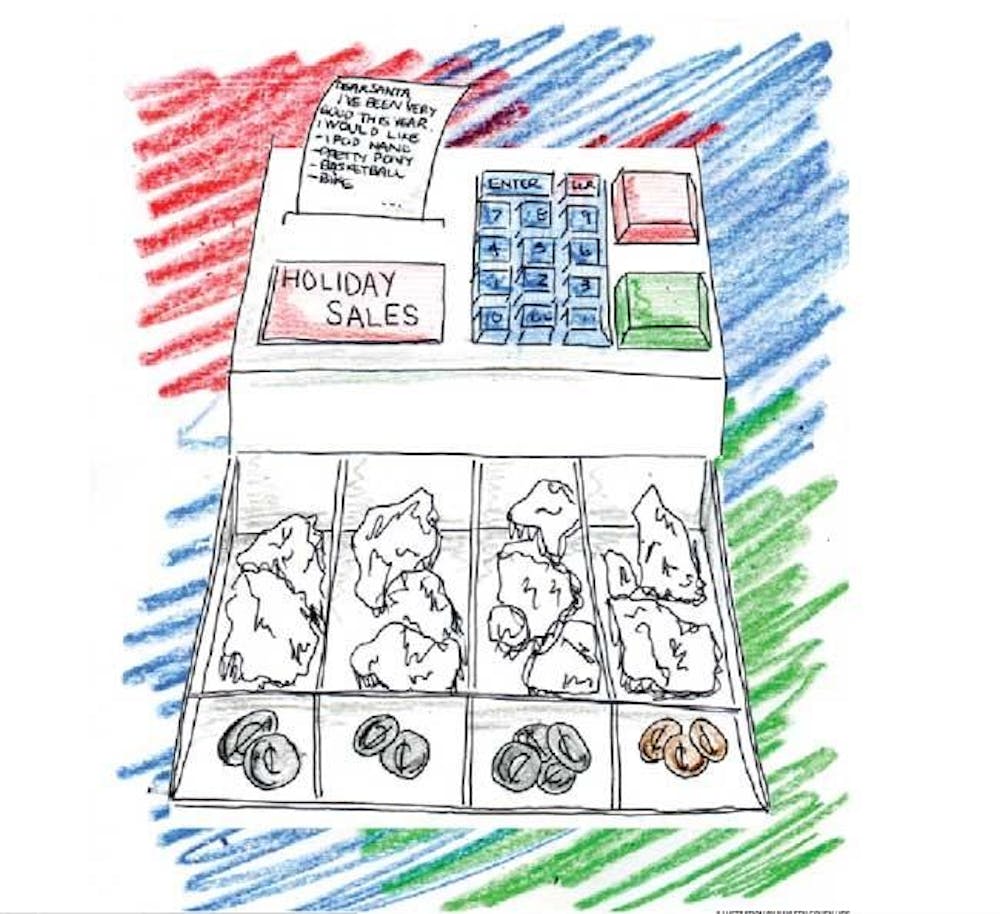

Who knows what we did, but the facts are undeniable: Santa Claus officially put our economy on the naughty list.

This year, retailers across the board are experiencing one of the least

profitable holiday shopping seasons ever. Usually these trends affect

some operations more than others, but this year, almost all retailers

are receiving the proverbial coal-filled stocking.

“Everybody is losing,” said Theresa Williams, director of the IU Center

of Education and Research in Retailing. “When you start to see every

retailer that you have public data on slipping, that’s usually a sign

that it’s more than one particular store or operation.

“For example, usually apparel gets hit worse than electronics. Now both apparel and electronics are down double digits.”

Experts say, for most retailers, the holiday season accounts for at least 35 percent of annual sales, Williams said.

Even seemingly popular stores such as Target are being forced to adapt.

While it’s brand promise has been “expect more, pay less” for more than

14 years, Target isn’t ignorant to which half of that promise is more

relevant this season.

“We don’t want to deviate from that promise because that’s what people

expect when they come into our stores,” said Target spokesperson Hadley

Barrows. “But we are focusing a little bit more on the ‘pay less’ side.”

Target’s marketing plan adapted to help shift that focus, Hadley said.

Still, the bleak outlook for this season remains. In November, Target’s

sales were down almost twice as far as projected.

But there is one retailer with cause to be merry.

Wal-Mart is experiencing a relatively profitable fourth quarter. In fact, its sales are higher than last year, Williams said.

“I think it’s the perception of customers in general,” Williams said. “They perceive Wal-Mart to be the lowest price, period.”

This perception might be skewed, she said. In a recent price check of

100 different products in stores across the country, Target’s average

price was only seven cents more than Wal-Mart’s.

Still, Wal-Mart’s marketing strategy of highlighting discount shopping

is working. The emphasis on one-stop shopping and low prices hasn’t

been lost on college students, either.

“My plan is just to go to Wal-Mart,” said sophomore Derek Andrews. “I think their message is going through.”

But what about the less fortunate retailers? Inventory management and

cutting costs are going to be key in minimizing the losses they

experience during this season, Williams said.

“There is some leeway in looking for where they can cut costs,” she

said. “Most of these companies are not at the very leanest in terms of

their operations.”

While Target has not yet announced plans for any layoffs, it has being

proactive in preventing further losses, Barrows said. In addition to

scaling back the growth of new stores, the store also temporarily

suspended its share-repurchasing program.

“Right now, we’re looking at tighter capital,” she said.

Retailers' lump of coal

Despite promotional efforts, stores see sales slump

Get stories like this in your inbox

Subscribe