A Senate committee passed an infrastructure improvement bill Tuesday that would hike up Indiana’s gas and diesel tax, despite some concerns that it is not fully clear yet how the bill will affect taxpayers.

The Senate Tax and Fiscal Policy Committee voted 11-2 — the two dissenting votes coming from Democrats — to pass House Bill 1002, which would increase the gas tax from 18 cents annually to 28. Bill author Edmond Soliday, R-Valparaiso, said the tax makes up for a lack of adjusting to inflation since 2002.

Sen. Mark Stoops, D-Bloomington, announced that his “no” vote was because he had not yet had sufficient time to review adjustments to the bill that were made Tuesday.

Before passing the bill, legislators discussed an amendment that splits the tax into a two-year phase.

The gasoline tax will increase five cents one year and then five cents the next, said Committee Chair Brandt Hershman, R-Buck Creek. The diesel tax will increase in three cent intervals throughout a two year period.

Soliday said the amendment “reflects the cooperative spirit” they have had since beginning work on the bill.

“Complex stuff, the state really needs it, and I’m really proud to work with you all,” Soliday said, addressing the Senate chambers.

Sen. Karen Tallian, D-Portage, echoed Stoops’ sentiment that there had not been sufficient time to review the additions to the bill, but voted yes to it regardless.

“I also believe that we have a huge infrastructure need in this state, and that my constituents are telling me to support this despite a tax increase, and so I’m voting yes,” she explained.

Sen. Travis Holdman, R-Markle, prefaced his “yes” vote by reiterating how necessary his constituents believe the infrastructure improvements to be.

They say they can live with a tax increase, provided all the funds do go to the roads, he said. The new amendment also adds a $100 commercial vehicle plate fee, as well as a $5 new tire tax.

Additionally, it contains “permissive language” allowing the Indiana Department of Transportation to implement tolling fees on any United States interstate, regardless of whether the road is new or old. This amendment would give the governor freedom to toll as he pleases.

Because the bill was amended, it must now be agreed upon by a conference committee before Gov. Eric Holcomb has the option to sign it into law.

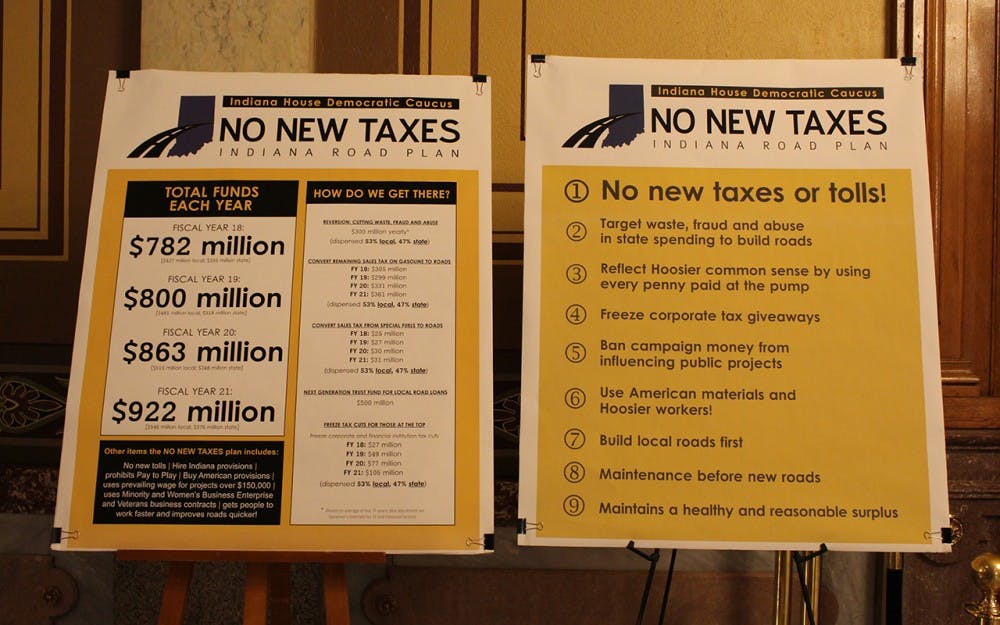

Hershman concluded the bill’s hearing by saying he believes the bill to be a bipartisan, collaborative effort, though signs put up next to the House chambers by the Indiana House Democratic Caucus calling for “no new taxes or tolls” seemed to suggest otherwise.

“This is a very large bill, and it remains a work in progress,” Hershman said. “We have taken input from a wide variety of stakeholders here.”