This past week, Purdue University announced that for the ninth straight year in a row, it will continue to freeze tuition prices. IU announced in contrast it will be raising its room and board costs by 3.46%, and it raised tuition costs by 2.5% for residents and 3% non-residents in 2019. So the question is, how did Purdue figure out how to keep costs stagnant while IU's rates continue to soar?

Purdue is clearly doing something right in controlling costs, and its methods should be studied and implemented all around the country.

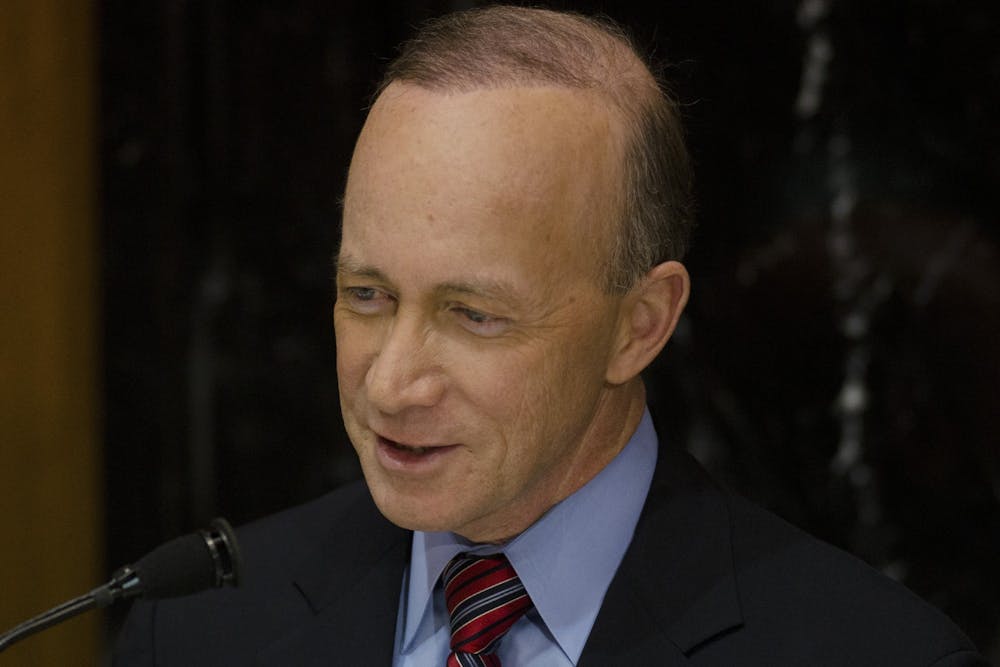

Under President Mitch Daniels, Purdue has been a pioneer in cost-cutting and finding ways to save money, allowing the university to charge approximately $1,000 less than IU for in-state tuition, and more than $7,500 less for out-of-state students.

IU claims its increase followed a national inflation index for the cost of higher education. But interestingly, Purdue didn’t need to adhere to this index, which was at 2.6% in 2019, higher than the average rate of inflation. This means students were charged hundreds of dollars more without being told what necessitated an increase, only that an index said costs were going up.

Specifically, Purdue has done an excellent job at cutting wasteful spending, allowing their costs to go down. When Daniels took over Purdue in 2013, he cut $8 million of waste from the operating budget, cut the cost of room and board by 5%, reduced dining hall prices by 10% and brokered a deal with Amazon to save students 30% on textbooks.

He also introduced a revolutionary program called “Degree in 3,” allowing some liberal arts students to earn a degree in 3 years, saving them 25% on their education.

Some might be concerned that quality of education was affected by cutting this much from the budget, but on the contrary, Purdue’s spot in the US News and World Reports best college rankings has actually increased from 64th in 2013 to 57th in 2020.

Last month, IU President Michael McRobbie penned an op-ed in the Chicago Tribune, in which he boasted “nearly half of all bachelor’s degree graduates leave the institution with zero student loan debt, and 82% have less than $30,000 (of debt).”

While I don’t dispute any of these facts, my reality as an out-of-state student is far different from the picture painted in the op-ed. My total cost of attendance is estimated to be more than $50,000 per year. Even with a scholarship, I still end up paying around $40,000. Over 4 years, that will amount to $160,000 to earn a degree.

Even with a well-paying job upon graduation — and exhausting my own savings and college fund — I will likely graduate with around $100,000 in debt that I will be paying off for about 10 years, severely limiting my ability to go to graduate school, buy a house before I’m 30 or save for the future. If I had chosen to attend Purdue, I would have saved $30,000. Maybe I should have been an engineer after all.

Brett Abbott (he/him) is a freshman studying finance and is the press secretary for College Republicans at IU. He plans to pursue a career in business or politics.