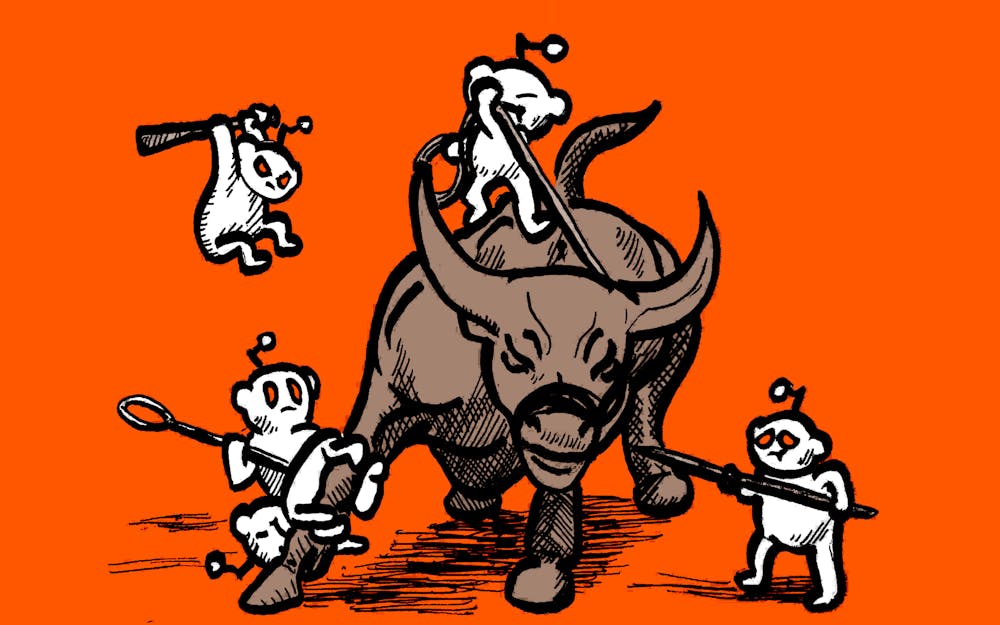

Last week, thousands of people organized on Reddit’s /r/wallstreetbets to short squeeze billionaire investors and hedge funds by rapidly raising GameStop stock’s price. These casual investors exploited reckless behavior by the wealthy, specifically mass short-selling of several falling stocks.

Initially, hedge funds began hemorrhaging billions and small investors rejoiced. Then Robinhood, the main company that small investors used to trade, restricted their purchases and even allegedly sold stock without users’ permission.

Investing companies should not restrict which shares can be bought and sold by ordinary investors when no such restrictions exist for those controlling most of the capital. There should not be different rules for billionaires.

The uproar to Robinhood’s restrictions was immediate and widespread. Politicians as different as Rep. Alexandria Ocasio-Cortez, D-N.Y., and Sen. Ted Cruz, R-Texas, condemned Robinhood’s actions, with few rushing to defend it. These small investors are only doing what hedge funds have been doing for decades.

These unjust limitations from Robinhood are a perfect example of why young people are disillusioned with America and capitalism. The rules keep changing to benefit those in charge.

My generation has now lived through two “once-in-a-lifetime” economic recessions, and most of us are barely adults. Productivity has continued rising, but real wages have stagnated over the past fifty years. Each generation since the baby boomers possesses less wealth than the previous. Gen Z is set to be even poorer than the famously poor millennials.

We have been told, most notably by former President Donald Trump, that the economy is doing well because the stock market has been doing well, even though unemployment has continued to skyrocket. But evidently, even the stock market isn’t actually meant to be used by average people.

And while stocks have risen, so has unemployment. Rising stocks have allowed American billionaires to add more than a trillion dollars total to their wealth, even while workers lost trillions through an economy comparable to the Great Depression.

This is the capitalism that my generation knows.

The market is ensuring that wealthy investors won't lose money from a monetary struggle with small investors. It continues the financial trend of the COVID-19 pandemic, where wealthy people are virtually unaffected while workers aren’t afforded the same opportunities. This disjoint is significant, and people are noticing.

GameStop is the canary in a coal mine.

Robinhood has taught many in the past week that under capitalism, the working class must stay exploited regardless of anything else. It has advertised itself as the platform for the small-time investor, but by restricting GameStop and other stock, it’s only affirming that it works for the wealthy.

There has already been a push for more regulation, spearheaded by Sen. Elizabeth Warren D-Mass. Ultimately, while regulation is necessary in general, calling for increased regulation right now is inappropriate after decades of ignoring similar behavior by wealthy investors. It only enforces the notion that there are different rules for different people.

These actions only entrenched the small investors’ convictions. Many users of /r/wallstreetbets have shared how their families’ lives were ruined by the 2008 financial crisis. One person posted about how their refusal to sell is inspired by their late wife’s battle with cancer. Another posted that they can now finally put their sister through Lyme disease treatment. But regardless of everyone’s individual motivations, one thing is clear — some people want the rich to hurt the way they have been hurt.

This anger is the inevitability of decades of capitalist propaganda. You can pull yourself up by your bootstraps if you’re tough and driven and smart, everyone richer than you deserves to be and it’s good for the economy that they have more than you — these are lies, and people are realizing it.

This market manipulation has only demonstrated what some have always known about capitalism: those with power will never give it up willingly. But if there is one thing to be learned from Reddit standing against Wall Street, it’s that there is power, too, in organizing. As long as we can recognize our class interests, we can stand strong against greed.

Noah Moore (he/him) is a sophomore studying psychology, theater and international studies. He is a Wells Scholar, off-campus representative in Student Body Congress and varsity dancer for the Singing Hoosiers. Noah enjoys listening to music and hiking around Lake Monroe.